SEC Adoption of Transaction Fee Pilot for NMS Stocks: A Penserra Perspective

(May 21, 2019) – Jason Valdez, Head of Global Equity Trading at Penserra, is in the business of providing institutional customers exceptional service paired with high-quality executions. Nearly twenty-five years of experience as both a buy-side and sell-side trader has enabled him to deliver on one half of this challenging dual mandate, and much of his day is spent formulating, conceptualizing, and delivering impactful market knowledge and strategies.

However, when it comes to getting his customers the best possible price, Mr. Valdez believes the present maker-taker trading platform preferred by the New York Stock Exchange, CBOE and Nasdaq, whereby the exchanges pay rebates to broker-dealers for order flow, creates a two-pronged disservice to institutional clients; one, creating an economic conflict of interest, and two, obscuring vital pools of liquidity. According to Mr. Valdez, these twin structural drawbacks create significant impediments towards providing institutional customers the best possible execution.

The Maker-Taker Platform: What is it?

The predominant fee model in U.S. equities markets is the “maker-taker” model, in which an exchange or other trading center pays broker-dealer participants a per-share rebate to provide (i.e., “make”) liquidity in securities and assesses those participants a fee to remove (i.e., “take”) liquidity. Under this model, exchanges and trading centers realize revenue from the difference between the fee paid by the “taker” and the rebate paid to the “maker.” Other trading centers use an inverted “taker-maker” model, in which they charge the provider of liquidity and pay a rebate to the taker of liquidity. The SEC currently regulates exchange access fees, including by prohibiting exchanges and trading centers from imposing (or permitting to be imposed) any fees for the execution of an order that exceed $0.0030 per share

This trading model arose after nearly two decades of regulatory and technological changes to the U.S. equity market. In 2001, the SEC squeezed trading profits by cutting the minimum price increment for U.S. shares to one cent, down from eighths or sixteenths of a dollar, reducing spreads for market makers. As a consequence, exchanges started paying to encourage electronic trading firms, particularly high-frequency traders, to provide standing orders to buy and sell.

The Maker-Taker Platform: What’s Wrong with It?

Institutional equity traders seek to execute trades on an exchange that offers the best terms for their clients, including the best price and likelihood of executing the trade. The exchanges are supposed to compete to offer the best execution opportunities.

But the reality is not matching the theoretical. Instead, brokers routinely take kickbacks, euphemistically referred to as “rebates,” for routing orders to a particular exchange. Consider this example. Based on the present structure of the maker-taker platform, the likelihood of executing a trade at the best price depends on the length of the queue to buy or sell and the incentives to trade. Longer queues lead to longer delays executing a trade. Delays in any today’s nano-second trading environment typically lead to worse outcomes. Quite simply, it makes no sense to wait on a longer line to receive a worse execution. As a result, the brokers produce worse outcomes for their clients. Although the harm suffered on each trade is minuscule- fractions of a cent per share- the aggregate rebates and discounts amount to billions of dollars a year.

And yet, brokers choose longer queues hundreds of thousands, if not millions, of times a day. Publicly available trade and quote data show that the queues to buy or sell stock are considerably longer on exchanges that offer kickbacks. Even though the queues decrease the likelihood of getting a trade completed and impair the price performance after the trade is executed, brokers still direct trades to these places because of the kickbacks they receive.

At its core, critics of the maker-taker platform believe the model distorts pricing because rebates and other discounts that do not show up in the bid/offer. Moreover, the trading noise created by high frequency traders taking advantage of rebates by buying and selling shares for the same price in order to make money on arbitrage has crowded out the price discovery process. “I’d like to see maker-taker go away,” says Mr. Valdez, who for years has been a vociferous critic of the maker-taker model. As the head of an agency-only broker dealer, Mr. Valdez has gone out of his way to avoid the obvious conflict of interest in exchange for fair flat rates with his execution partners. “I never want to be in a situation where I have to decide first about which route to choose because it’s cheapest or offers the highest rebate vs. where to go to achieve the best price.”

In Search of a Solution: Transaction Fee Pilot for NMS Stocks

Following years of debate, on March 14, 2018, the Securities and Exchange Commission (SEC) proposed new Rule 610T of Regulation NMS, which would establish a pilot program to study the effects of potential changes considered by the SEC on certain transaction fees and rebates paid by exchanges to broker-dealers and market makers. The Transaction Fee Pilot (TFP) program would subject stock exchange transaction fee pricing, such as the common “maker-taker” pricing model, to temporary restrictions across three test groups and require certain exchanges to prepare and publicly post data on the effects, if any, of the pilot program. The program is intended to help the SEC evaluate the need for regulatory action in this area and may be modified, perhaps materially, prior to implementation in response to comments.

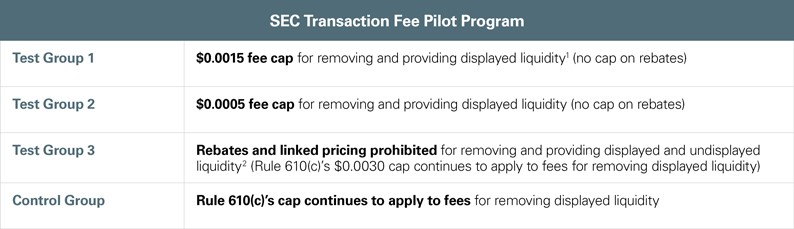

The TFP program would feature three test groups, with each containing 1,000 stocks. Each test group would employ varying levels of access fees and rebates as described in the table below.[1] Stocks not selected for inclusion in a test group would comprise a control group. The SEC intends to publish on its website the list of securities subject to the pilot program.

The TFP program would last for two years with an automatic sunset at one year unless renewed by the SEC. There would be a six-month pre-pilot program period and a six-month post-pilot program period. The chart below outlines the proposed test groups:

Response from the Exchanges: Illegal Government Overreach

The TFP program was set take effect in April 22, 2019. However, On February 14, 2019, the New York Stock Exchange (“NYSE”) filed a petition for review to the U.S. Court of Appeals for the District of Columbia Circuit against the Securities Exchange Commission (“SEC”), seeking review of the program. The CBOE and Nasdaq literally followed suit a day later, with nearly identical petitions.[2] The petitions seek a ruling that the pilot program is unlawful under the Securities Exchange Act of 1934 and the Administrative Procedure Act and a permanent injunction barring the SEC from implementing the pilot program. Furthermore, the TFP “is arbitrary and capricious and otherwise not in accordance with law; does not promote efficiency, competition, and capital formation; and exceeds the Commission’s authority.”

Transaction Fee Pilot Program: What Happens Now?

In response to the lawsuits filed by the exchanges, on March 26, 2019, the SEC agreed to temporarily halt part of is TFP program.[3] The grant of a partial stay was viewed initially as a “win” by the exchanges. However, the SEC partial stay did not pause a six-month data gathering phase, which is required by the TFP to be completed before the rebate restrictions kick in, to allow analysis of how markets for test stocks change in response to the pilot. If the SEC provides notice in May that the data gathering will begin in June, for instance, the rebate ban for test stocks could start in December, assuming the court has reached a decision rejecting the exchange’s challenge by that time. If not, the pilot could still proceed following a later decision that is favorable to the SEC, but the Commission would have to decide how to address any gap between the data gathering period and the onset of the pilot restrictions.

Conclusion

The impact of access fees and rebates on U.S. equity markets continues to be the subject of significant and sharp debate. The TFP pilot program is supported by members of the Council of Institutional Investors, which represents public pension funds, corporate pension funds, endowments and foundations with a collective $4 trillion in assets.

In a recent opinion piece published on their website, the New York Stock Exchange stated that they are suing their regulator to “protect the market.” However, critics of the maker-taker system believe the NYSE is concerned only about protecting their market, not the U.S. market.

[1] “SEC’s Proposed Transaction Fee Pilot Program Continues to Provoke Discussion,” Skadden.com, July 16, 2018.

[2] “Where is the Love? Exchanges Sue SEC Over Market Access Fee Pilot,” National Law Review, Feb. 27, 2019.

[3] “SEC Delays Program to Rein In Rebates in Win for Stock Exchanges,” WSJ.com, March 28, 2019.

The information contained in this communication is not intended as an offer or solicitation for the purchase or sale of any securities, futures, options, or any other investment product. This communication is not research and does not contain enough information on which to make an investment decision. The information herein has been obtained from various sources. We do not guarantee its accuracy. Any opini ons expressed in this material reflect our judgment at this date and are subject to change. No part of this material may be reproduced in any manner without the prior written permission of Penserra Securities Management, LLC, Penserra Capital Management LLC and Penserra Transition Management LLC. The strategies referred to herein are among various investment strategies that are managed by Penserra Securities LLC, Penserra Capital Management LLC and Penserra Transition Management LLC (together, “Penserra”) as part of its investment management fiduciary services, or execution services. Penserra Securities LLC is a member FINRA, MSRB, SIPC; Penserra Capital Management LLC is an investment advisor registered with the SEC; and Penserra Transition Management LLC is an investment advisor registered with the State of California and State of New York.