The Breathtaking Growth of ESG Investing

(March 25, 2019) – Connie Kreutzer, Penserra’s Head of Institutional Sales, likes to query asset managers, pension plans and consultants as to what they believe the current percentage of assets under professional management in the U.S. are directed toward ESG (Environmental, Social and Governance) investment strategies. Nearly all provide answers corresponding to single digits.

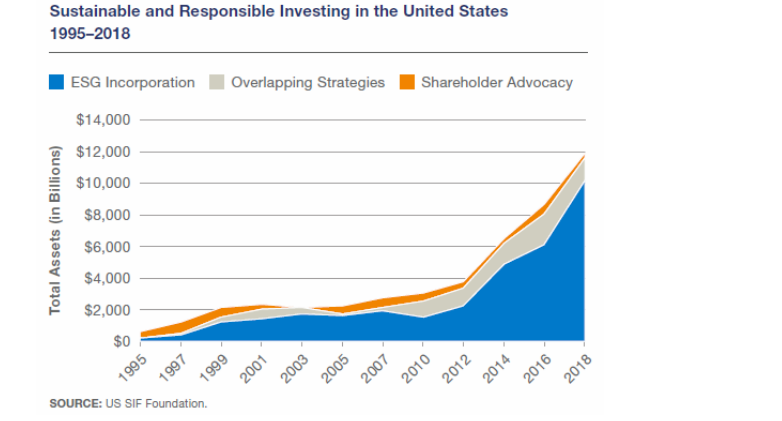

Imagine their surprise when she informs them that approximately 26%, or one out of every four dollars, is invested using ESG strategies. According to the US SIF Foundation’s 2018 biennial report, “sustainable, responsible and impact investing (SRI) assets now account for $12.0 trillion of the $46.6 trillion in total assets under professional management in the United States.”[i]

Here’s something else to consider. According to that same report, the 2018 figure of $46.6 trillion represents a 38 percent increase over 2016.

At Penserra, it is our mission to continuously examine and evaluate the ever-changing financial markets, and that includes consideration of the concepts, applications and discourse behind ESG Investing. Ironically, Penserra’s name contains elements related to ESG. It is derived from the Spanish words “pensar,” which means “to think,” and “tierra,” which means “earth” or “land.”

What is ESG Investing?

ESG investing, used synonymously with sustainable investing or socially responsible investing, is an investment strategy aiming to incorporate environmental, social and governance factors into investment decisions. Investment criteria encompass a set of standards for a company’s operations that socially conscious investors use to screen potential investments, including but not limited to;

Environmental

- Climate change

- Resource depletion

- Waste and pollution

- Deforestation

Social

- Working conditions

- Local communities

- Health and Safety

- Employee relations

- Diversity

Governance

- Executive pay

- Bribery and corruption

- Political lobbying and donations

- Board diversity and structure

- Tax strategy

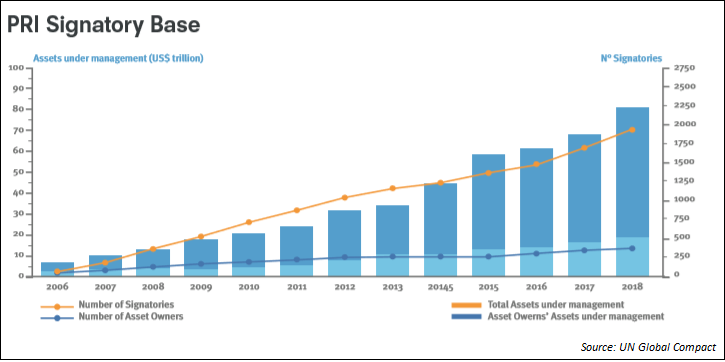

The story of ESG investing began in January 2004 when former United Nation’s Secretary General Kofi Annan wrote to over 50 CEOs of major financial institutions, inviting them to participate in a joint initiative under the auspices of the UN Global Compact and with the support of the International Finance Corporation (IFC) and the Swiss Government. The goal of the initiative was to find ways to integrate ESG into capital markets. A year later this initiative produced a report entitled “Who Cares Wins.” The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. At the same time UNEP/Fi produced the so-called “Freshfield Report” which showed that ESG issues are relevant for financial valuation. These two reports formed the backbone for the launch of the Principles for Responsible Investment (PRI) at the New York Stock Exchange in 2006 and the launch of the Sustainable Stock Exchange Initiative (SSEI) the following year.

Today, the UN-backed PRI is a thriving global initiative with over 2,200 members representing over $80 trillion assets under management. The SSEI, supported by the Geneva-based UNCTAD, has grown over the years with many exchanges now mandating ESG disclosure for listed companies or providing guidance on how to report on ESG issues.[i]

Why Invest Responsibly?

ESG investing was once viewed as a niche segment involving a trade-off between value and “values”. This is no longer the case. Socially responsible investing is now considered mainstream, and as the numbers above clearly indicate, it’s something investors cannot afford to ignore. ESG investing has evolved over the years from simply screening out companies based on religious, moral or ethical grounds, to including companies to reward good behavior or encouraging them to change business practices. Moreover, ESG investing lets investors better pinpoint favored causes, such as addressing climate change or advocating for more women on corporate boards.

According to the UN-backed Principles for Responsible Investment, the global momentum propelling the growth of responsible investment is primarily driven by:[i]

- Recognition in the financial community that ESG factors play a material role in determining risk and return.

- Understanding that incorporating ESG factors is part of investors’ fiduciary duty to their clients and beneficiaries.

- Concern about the impact of short-termism on company performance, investment returns and market behavior.

- Legal requirements protecting the long-term interests of beneficiaries and the wider financial system.

- Pressure from competitors seeking to differentiate themselves by offering responsible investment services as a competitive advantage.

- Beneficiaries becoming increasingly active and demanding transparency about where and how their money is being invested.

- Value-destroying reputational risk from issues such as climate change, pollution, working conditions, employee diversity, corruption and aggressive tax strategies in a world of globalization and social media.

A survey published in February 2019 of 300 respondents employed at U.S. asset management firms with at least $50 million in assets under management reported that 75% of their firms have adopted sustainable investing, up from 65% in 2016. Other key findings from the survey include that 89% of asset managers believe sustainable investing is here to stay, with 63% expecting it to continue growing over the next five years. Also, 82% of respondents believe that strong ESG practices can lead to higher profitability and that companies with such practices might be better long-term investments. Meanwhile, nearly two-thirds of asset managers (62%) believe it’s possible to maximize financial returns while investing responsibly. Many managers employ a full spectrum of sustainable investing approaches, with 63% employing more than one strategy across shareholder engagement, restriction screening, ESG integration, thematic investing and impact investing. Lastly, and perhaps most compelling, 89% of respondents said their firms will devote more resources to sustainable investing in the next two years. Common strategies for developing in-house skills and capacity include employee training (41%), dedicating more employee time (36%) and specialist hires (34%).[ii]

Fiduciary Duties and ESG Integration

When a fiduciary manages financial assets for a pension plan, an endowment, or a private trust, the fiduciary acts for the benefit of the beneficiaries, both current and future. When fiduciaries invest assets held for others, they must act as prudent investors. The definition of a prudent investor is fluid, however, and shifts with developments in financial theories and investment processes. The prudent investor standard depends on investing norms, and those norms change to incorporate new ideas and new information.

As evidence mounts that consideration of ESG factors can improve risk-adjusted returns, more financial analysts use some form of ESG integration.[iii] The complication for a fiduciary, however, is that these factors may also reflect benefits or costs beyond the company’s financial bottom line. Environmental factors may indicate whether a company improves the environment or damages it. Social factors may reflect whether workers are paid a fair wage or are subject to sweatshop conditions. These extra-financial impacts may be important to investors, and certainly are important to the health of the environment and the workers, but due to outdated understandings of “social investing” some fiduciaries worry that any strategy that considers environmental or social impacts is problematic. As such, fiduciaries are faced with two persistent dilemmas concerning the use of ESG factors in investment decision making; incorporating ESG principles may result in lower returns, and fiduciary duties preclude a fiduciary from doing so. The dichotomy, which must be considered from both legal and investment perspectives, involves challenges that include:[iv]

- Outdated perceptions about fiduciary duty and responsible investment. This is particularly the case in the U.S. where lawyers and consultants too often characterize ESG issues as non-financial factors.

- A lack of clarity within prevailing definitions of fiduciary duty about what ESG integration means in practice and whether active ownership and public policy engagement form part of investors’ fiduciary duties.

- Limited knowledge of the evidence base for responsible investment, including the strength of the relationship between ESG issues and investment performance.

- Lack of transparency on responsible investment practices, processes, performance and outcomes, limiting investors’ accountability to their beneficiaries, their clients and wider society.

- Inconsistency in corporate reporting, including inadequate analysis of the financial materiality of ESG issues, making it hard to assess investment implications.

- Weaknesses in the implementation, oversight and enforcement of legislation and industry codes on responsible investment.

To overcome these challenges related to socially responsible investing, and to ensure that ESG integration refers to an investment strategy that does not anticipate a loss in financial return, government policy makers and security regulators should:[v]

- clarify that fiduciary duty requires investors to take account of ESG issues in their investment processes, in their active ownership activities, and in their public policy engagement;

- strengthen implementation of legislation and codes, clarifying that these refer to ESG issues, and require investor transparency on all aspects of ESG integration, supported by enhanced corporate reporting on ESG issues

- clarify the expectations of trustees’ competence and skill and support the development of guidance on investor implementation processes, including investment beliefs, long-term mandates, integrated reporting and performance;

- support efforts to harmonize legislation and policy instruments on responsible investment globally, with an international statement or agreement on the duties that fiduciaries owe to their beneficiaries – this statement should reinforce the core duties of loyalty and prudence, and should stress that investors must pay attention to long-term investment value drivers, including ESG issues, in their investment processes, in their active ownership activities, and in their public policy engagement.

The bottom line is this: fiduciaries must analyze investments and investment strategies based not on what a prudent investor would have done in the 1980s, but on the information available from researchers examining financial tools and understandings today. In today’s investment climate, fiduciaries must consider the new norm of long-term investment drivers of socially responsible investing.

A Generational Divide: Baby Boomers vs. Millennials

A 2018 survey by TD Ameritrade found that 60% of millennials, who are now in their early twenties to late thirties, and came of age during the financial crisis, think making socially responsible investments is important, compared to 36% of baby boomers.[vi] Interest in ESG investing is growing, especially among affluent younger investors. Nearly four in 10 (37%) of high net worth investors have reviewed their investment portfolios for ESG impact, up from 34% in 2017 and 23% in 2015. “It’s no secret that it’s a generation that’s driven by purpose,” said Lule Demmissie, managing director of investment products and guidance at TD Ameritrade.

Demmissie noticed subtle generational differences in the survey results. Millennial investors who are interested in socially responsible investing preferred to make “proactive” investments. They wanted to invest in companies that are striving toward social change through concrete actions like cultivating diverse boards.

Boomers, on the other hand, expressed their desire for socially responsible investment by screening certain sectors out of their portfolios, like fossil fuels or weapons manufacturing, and including other sectors, like clean energy — but not because those companies necessarily operate in a certain way.

But performance isn’t the top priority for all investors. Among investors of all ages in the TD Ameritrade survey, most (67%) said they cared more about advancing social and environmental causes than the return rate, which was a priority for 17% of respondents. Among millennial investors, 21.7% said the most important factor when making socially responsible investments was the goals of the companies they’re investing in, while 14.4% said the most important factor was the rate of return, the survey found. Of all the generations surveyed, Generation X cared most about the rate of return: 28% of investors that age said returns were the most important factor.

Summary

With momentum driven by investors, asset managers and consultants are critiquing companies based on their sustainability factors or ESG standards. There is a growing belief that environmentally conscious companies that manage their internal and external relationships well and maintain strong corporate governance will experience sustainable growth into the future. Integrating ESG issues into investment research and processes will enable investors to make better investment decisions and improve investment performance consistent with their fiduciary duties. This will result in capital being allocated towards well-governed companies, putting investors in a better position to contribute to the goals of a greener economy and a more sustainable society

Incorporating ESG strategies in a portfolio in large part comes down to personal feelings on environmental, social and corporate-governance standards. Clients may be willing to sacrifice some performance in order to vote with their dollars on topics they are most passionate about. Additionally, financial professionals and fiduciaries will need to overcome the lack of analytic applications to find the best strategy that falls in line with the client’s unique interpretation of ESG investing.

In 2018, thousands of professionals from around the world hold the job title “ESG Analyst” and ESG investing is the subject of news articles in the financial pages of the world’s leading newspapers. Many investors recognize that ESG information about corporations is vital to understand corporate purpose, strategy and management quality of companies.

ESG investing is now, quite literally, big business.

[i] “What is Responsible Investment?” UNPRI.org

[ii] “Asset Managers See Opportunity in Sustainable Investing,” Morgan Stanley Institute for Sustainable Investing, February 21, 2019

[iii] “Sustainable Investing is Simply Smart Investing,” BlackRock.com

[iv] “What is Responsible Investment?” UNPRI.org

[v] “What is Responsible Investment?” UNPRI.org

[vi] https://www.marketwatch.com/story/some-millennial-investors-care-more-about-doing-good-than-making-money-2018-09-10

The information contained in this communication is not intended as an offer or solicitation for the purchase or sale of any securities, futures, options, or any other investment product. This communication is not research and does not contain enough information on which to make an investment decision. The information herein has been obtained from various sources. We do not guarantee its accuracy. Any opini ons expressed in this material reflect our judgment at this date and are subject to change. No part of this material may be reproduced in any manner without the prior written permission of Penserra Securities Management, LLC, Penserra Capital Management LLC and Penserra Transition Management LLC. The strategies referred to herein are among various investment strategies that are managed by Penserra Securities LLC, Penserra Capital Management LLC and Penserra Transition Management LLC (together, “Penserra”) as part of its investment management fiduciary services, or execution services. Penserra Securities LLC is a member FINRA, MSRB, SIPC; Penserra Capital Management LLC is an investment advisor registered with the SEC; and Penserra Transition Management LLC is an investment advisor registered with the State of California and State of New York.

[i] “The Remarkable Rise of ESG,” Forbes, July 11, 2018

[i] U.S. SIF Foundation 2018 Report on U.S. Sustainable, Responsible and Impact Investing Trends.